How much money could you save if your finances were a person?

Have you ever stopped to think about how much money you could save if your finances were a person? Imagine if your financial situation had a physical representation – a tangible being that you could interact with, evaluate, and ultimately, improve. Giving your finances a personality can be a fun and effective way to approach financial planning and goal setting. Let’s explore this concept further and see how it can help you save money and achieve your financial goals.

Understanding Your Financial Persona

Just like any person, your finances have habits, strengths, and weaknesses that shape your overall financial well-being. By personifying your finances, you can gain a better understanding of your spending patterns, savings habits, and investment strategies. This approach can help you identify areas where you excel and areas where you need to improve.

- Tracking Expenses: If your finances were a person, they would meticulously keep track of every expense, big or small. By adopting this habit, you can gain a better understanding of where your money is going and identify opportunities to cut back on unnecessary spending.

- Setting Financial Goals: Just like setting personal goals, your financial persona can help you define clear objectives for saving and investing. Whether it’s saving for a new car, a dream vacation, or retirement, having specific financial goals in mind can motivate you to make smarter money decisions.

- Creating a Budget: Your financial persona would be a budgeting pro, ensuring that your income is allocated wisely to cover expenses, save for the future, and enjoy some discretionary spending. By following a budget, you can avoid overspending and make sure you’re on track to meet your financial goals.

The Money-Saving Potential of Your Financial Persona

Now, let’s delve into the practical aspects of how much money you could save if your finances were a person. By embodying the traits of a financially savvy individual, you can unlock significant savings and build a strong financial foundation for the future.

- Reducing Impulse Purchases: Your financial persona would steer you away from impulsive buying decisions and encourage you to think twice before making a purchase. This conscious approach can help you avoid unnecessary expenses and save money in the long run.

- Comparing Prices: Just like a savvy shopper, your financial persona would always look for the best deals and compare prices before making a purchase. By taking the time to research and find the most cost-effective options, you can save a considerable amount of money on everyday purchases.

- Automating Savings: Your financial persona would prioritize saving by automating regular contributions to your savings or investment accounts. By setting up automatic transfers, you can ensure that a portion of your income goes towards savings before you have a chance to spend it elsewhere.

Calculating Your Money-Saving Potential

So, how much money could you save by embodying the traits of a financially responsible individual? To get a better sense of your money-saving potential, consider the following steps:

- Track Your Spending: Start by tracking your expenses for a month to see where your money is going. This exercise can help you identify areas where you can cut back and save more.

- Set Savings Goals: Determine specific savings goals based on your financial priorities, whether it’s building an emergency fund, saving for a down payment on a house, or investing for retirement.

- Implement Money-Saving Strategies: Incorporate money-saving strategies into your daily routine, such as cooking at home instead of eating out, using coupons for shopping, and negotiating better deals on services.

- Monitor Your Progress: Regularly review your financial habits and track your progress towards your savings goals. Making adjustments as needed can help you stay on track and achieve financial success.

Conclusion

Personifying your finances can provide valuable insights into your money habits and help you make smarter financial decisions. By treating your financial situation as a person with distinct traits and behaviors, you can better understand where you stand financially and identify ways to improve your financial well-being. Remember, saving money is not just about cutting back on expenses – it’s about making conscious choices that align with your long-term financial goals. So, if your finances were a person, how would they inspire you to save more and achieve financial success?

#FinancialGoals #MoneyManagement #SaveMoney #PersonalFinanceTip

#FinancialGoals #MoneyManagement #SaveMoney #PersonalFinanceTip

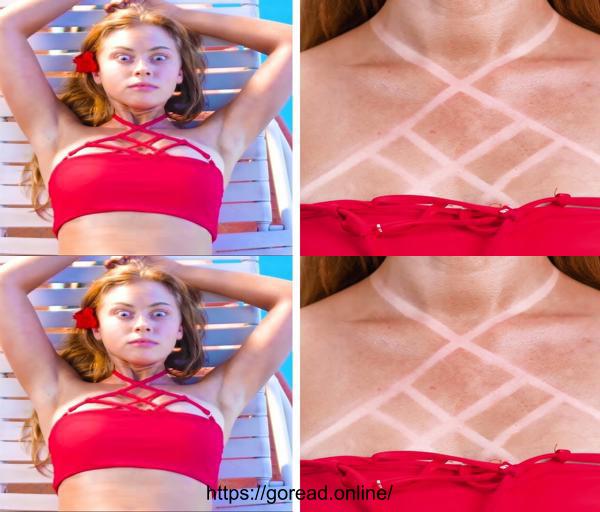

#SummerBeauty #DIYHacks #FashionTips #BeautyHacksByBlossom

#SummerBeauty #DIYHacks #FashionTips #BeautyHacksByBlossom